GST Amnesty Scheme 2024: Waiver of Interest and Penalty – Forms GST SPL-01 and GST SPL-02 Now Available on GST Portal

GST Amnesty Scheme 2024

GST Amnesty Scheme 2024: Waiver of Interest and Penalty – Forms GST SPL-01 and GST SPL-02 Now Available on GST Portal

GST Amnesty Scheme 2024

GST Amnesty Scheme 2024: Waiver of Interest and Penalty - Forms GST SPL-01 and GST SPL-02 Now Available on GST Portal

Under the GST Amnesty Scheme 2024, taxpayers are provided with a waiver of interest and penalty for demand notices, statements, or orders issued under Section 73 of the CGST Act for tax periods between July 2017 and March 2020. Taxpayers are required to file applications in either FORM GST SPL-01 or GST SPL-02 on the GST portal as applicable.

- Taxpayers\' attention is drawn to the advisory issued by GSTN on 29.12.2024, providing guidance on the scheme.

- Forms GST SPL-01 and GST SPL-02 are now available on the GST portal, and taxpayers are advised to file applications under the waiver scheme promptly.

- One of the eligibility conditions for filing an application under the waiver scheme is the withdrawal of appeal applications filed against the relevant demand orders, notices, or statements.

- For appeal applications (FORM GST APL-01) filed before the First Appellate Authority, the withdrawal option is already available on the GST portal.

- However, for appeal applications (FORM GST APL-01) filed before 21.03.2023, where the withdrawal option is not available on the GST portal, taxpayers must submit a withdrawal request to the concerned Appellate Authority. The Appellate Authority will forward such requests to GSTN via the State Nodal Officer for withdrawal from the backend.

- For appeal applications (FORM GST APL-01) filed before the First Appellate Authority, the withdrawal option is already available on the GST portal.

- Any difficulties faced by taxpayers in accessing or utilizing the scheme may be reported by raising a ticket under the category “Issues related to Waiver Scheme” at https://selfservice.gstsystem.in.

Step by step guide for eligible taxpayers to apply using GST SPL-02 form

Good news for GST registered taxpayers who wish to avail the GST Amnesty Scheme waiver of interest and penalty under section 128A announced in Budget 2024. GST SPL 01 & SPL 02 forms, using which a GST registered person can apply for this Amnesty Scheme, has now been enabled on the GST portal.

Taxpayers who have only been issued a notice under section 73 but no final order has been passed need to apply for the Amnesty Scheme using GST SPL 01 form. Form GST SPL 02 applies to situations where an order has been passed by the authorities at the first level tax authorities or by the appellate authorities.

Who can apply for GST Amnesty Scheme 2024 under section 128A.

The Amnesty scheme under section 128A grants waiver of interest and penalty liabilities relating to the period July 1, 2017 to March 31, 2020, in cases that do not involve fraud or wilful misstatement or suppression of facts.

“The scheme covers notices or statements issued under Section 73, and the proceedings following thereafter till the order of the first appellate authority, against which no appeal has been filed before the appellate tribunal. It also covers situations where the proceedings that were initiated under Section 74 as involving fraud, wilful misstatement or suppression of facts, but were ordered to not be involving these ingredients subsequently pursuant to Section 75(2). For context, Section 75(2) provides that where any appellate authority, appellate tribunal, court concludes that a case, which was initiated under Section 74 as involving fraud, wilful misstatement or suppression, did not involve such elements, the liabilities in such a case will be determined by deeming it be proceedings under Section 73. Notably, the situations where any interest or penalty liabilities on account of late fee, redemption fine etc. are not covered under the scheme,

How to apply for GST Amnesty Scheme 2024 under section 128A

GSTN in the advisory said the process to file GST SPL 02 is fully online and it can be filed from the GST portal only. However before filing the application for GST Amnesty Scheme under section 128A you need to pay the disputed GST liability.

Here’s a step by step guide on how to file the application for GST Amnesty Scheme under section 128A:

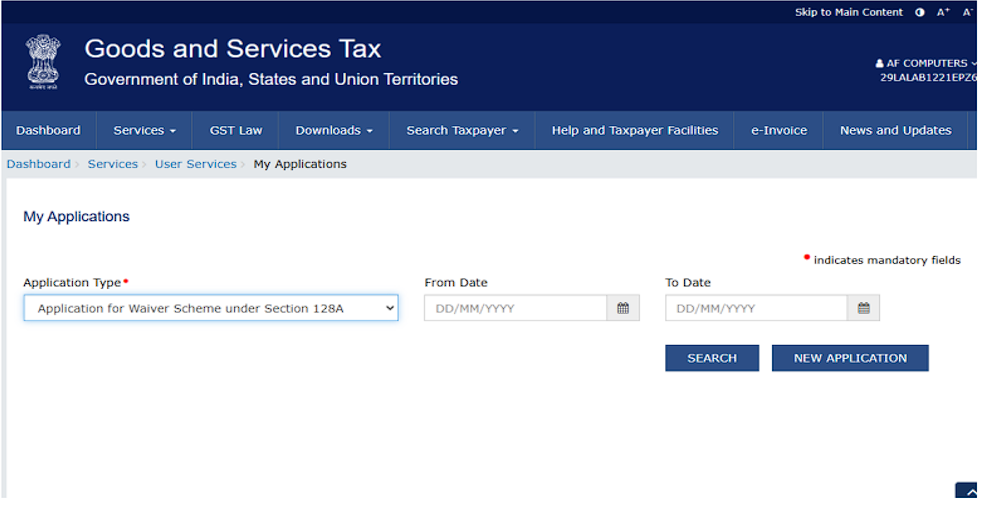

Step 1: Login into the GST portal and then navigate to ‘Services’ and then click on ‘User Services’ and then select ‘My Applications’. On Navigating to ‘My Applications’ page, you have to select ‘Apply for Waiver Scheme under Section 128A’ option under ‘Application type’ dropdown. If you want to file a new application for availing waiver on Interest and Penalty, then clic on ‘New Application’ button.

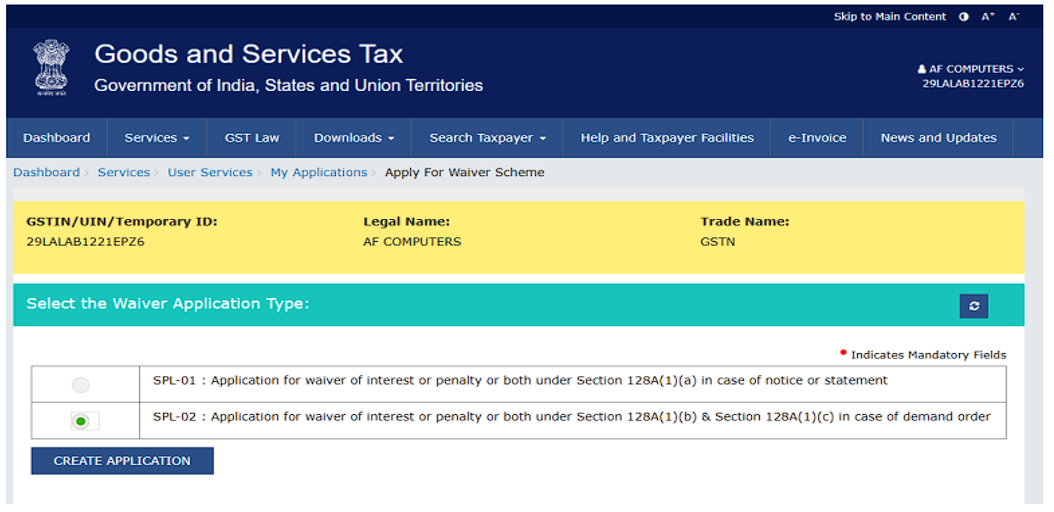

Step 2: On click of ‘New Application’, you will be able to see two forms:

SPL-01: Application for waiver of interest or penalty or both under Section 128(1)(a) in case of notice or statement.

SPL-02: Application for waiver of interest or penalty or both under Section 128(1)(b) & Section 128(1)(c) in case of demand order. On selection of SPL-02, the ‘CREATE APPLICATION’ button will be enabled.

On clicking the ‘CREATE APPLICATION’ button , a questionnaire will appear on the dashboard. After answering all the mandatory questions you have to click the ‘NEXT’ button to proceed further. The SPL-02 form will be displayed on the dashboard.

Step 4: After clicking the ‘File’ button, a warning message will appear: “Do you wish to proceed with filing the application?” Select ‘Ok’ to proceed or ‘Cancel’ to make modifications to the form. Upon selecting ‘Ok’, the application can be filed using either a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC). An Application Reference Number (ARN) will be generated upon the successful submission of the form.

Which Taxpayers Can Use GST SPL-02 Form to Apply for the Amnesty Scheme Under Section 128A

- Taxpayers with Final Orders Issued Under Section 73:

- Taxpayers who have received a final order under Section 73 and have filed an appeal, but no order on the first appeal has been passed under Section 107 of the CGST Act.

(Refer: Section 128A(1)(b))

- Taxpayers who have received a final order under Section 73 and have filed an appeal, but no order on the first appeal has been passed under Section 107 of the CGST Act.

- Taxpayers with First Appeal Orders Issued Under Section 107:

- Taxpayers who have received an order on the first appeal under Section 107 and have filed a second appeal, but no order on the second appeal has been passed under Section 113 of the CGST Act.

(Refer: Section 128A(1)(c))

- Taxpayers who have received an order on the first appeal under Section 107 and have filed a second appeal, but no order on the second appeal has been passed under Section 113 of the CGST Act.

- Taxpayers With Reclassified Proceedings:

- Taxpayers who were initially issued a notice under Section 74 of the CGST Act (pertaining to suppression, misstatement, or intentional evasion of tax), but the proceeding was subsequently reclassified as a Section 73 proceeding.

(Refer: First Proviso to Section 128A(1))

- Taxpayers who were initially issued a notice under Section 74 of the CGST Act (pertaining to suppression, misstatement, or intentional evasion of tax), but the proceeding was subsequently reclassified as a Section 73 proceeding.

These taxpayers can file Form GST SPL-02 electronically on the GST portal to avail the benefits under the Amnesty Scheme.

What are the Conditions to Avail GST Waiver Scheme

The GST Waiver Scheme under Section 128A provides relief in terms of interest and penalty but comes with specific conditions that taxpayers must meet to qualify. The key conditions are as follows:

- Disputed Matter Requirement:

- The first condition is that the matter must be under dispute.

- If the taxpayer has already paid the interest and penalty voluntarily to avoid litigation or for peace of mind, they will not be eligible for the waiver.

- Interest and penalty amounts already paid will not be refunded under this scheme.

- Amnesty benefits are applicable only in non-fraudulent situations.

- The first condition is that the matter must be under dispute.

- Application Requirement and Deadline:

- Amnesty benefits are not automatic. Taxpayers must file an application within a specific timeline.

- The application must be submitted in the prescribed forms, either GST SPL-01 or GST SPL-02, as applicable.

- Amnesty benefits are not automatic. Taxpayers must file an application within a specific timeline.

- Payment of Tax:

- While interest and penalty waivers are offered, the tax amount related to the demand or notice must be paid.

- For notices that are yet to be adjudicated, the tax payment must be completed electronically by 31st March 2025 for all standard cases.

- In certain special cases, a deadline of 6 months from the date of communication of the order is provided.

- While interest and penalty waivers are offered, the tax amount related to the demand or notice must be paid.

- Proof of Payment:

- Taxpayers must submit proof of tax payment in Form DRC-03 along with their waiver application (GST SPL-01 or GST SPL-02).

- Taxpayers must submit proof of tax payment in Form DRC-03 along with their waiver application (GST SPL-01 or GST SPL-02).

By fulfilling these conditions, taxpayers can avail themselves of the benefits under the GST Waiver Scheme 2024.

What is the deadline to apply for GST Amnesty Scheme under section 128A

To benefit from the GST Amnesty Scheme under Section 128A, taxpayers must adhere to two key deadlines:

- GST Tax Demand Payment Deadline:

- For all standard cases, the tax payment must be made electronically by 31st March 2025.

- In certain specific cases, taxpayers are given a special deadline of 6 months from the date of communication of the order to make the payment.

- For all standard cases, the tax payment must be made electronically by 31st March 2025.

- Application Submission Deadline:

- The application in the prescribed form (GST SPL-01 or GST SPL-02) must be submitted within the specified timeline.

- The application in the prescribed form (GST SPL-01 or GST SPL-02) must be submitted within the specified timeline.

Important Note:

Only when both the tax payment and the application submission deadlines are met will the GST department consider the Amnesty Scheme application.

GST tax demand payment deadline

To avail of the waiver under Section 128A:

- The full tax liability must be paid by March 31, 2025.

- If the tax liability is redetermined by the proper officer in an order issued under Section 75, the payment must be made within six months from the date of such order.

- Note: If interest or penalty has already been paid, no refund for these amounts can be claimed.

GST Amnesty Scheme Application Submission Deadline

- Tax payment must be made on or before March 31, 2025.

- As per Section 128A(1) read with Rule 164(6), the procedural forms (GST SPL-01 or GST SPL-02) must be filed within three months from March 31, 2025, making the cut-off date June 30, 2025.

- For cases involving a proceeding under Section 74 that is reclassified under Section 73, the application must be filed within six months from the date of communication of the order by the proper officer.

Which Taxpayers Need to Use GST SPL-01 and GST SPL-02 Forms?

- GST SPL-01:

Taxpayers should use this form if:- A notice or statement under Section 73 has been issued demanding tax for the period July 2017 to March 2020, but no order under Section 73 has been issued.

- A notice or statement under Section 73 has been issued demanding tax for the period July 2017 to March 2020, but no order under Section 73 has been issued.

- GST SPL-02:

Taxpayers should use this form if:- An order has been issued under Section 73, Section 107, or Section 108, but no order has been issued under Section 113.

- An order has been issued under Section 73, Section 107, or Section 108, but no order has been issued under Section 113.

Key Clarification:

- The choice between GST SPL-01 and GST SPL-02 depends entirely on the status of the assessment.

- If the matter is at the Show Cause Notice/Demand stage, file GST SPL-01.

- If an order has already been passed, file GST SPL-02.

- If the matter is at the Show Cause Notice/Demand stage, file GST SPL-01.

- Note: There is no situation where a taxpayer must file both forms. It is always an either/or situation.

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 9633181898 or via WhatsApp at 9633181898.

Featured Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

Latest Posts

- Restoration of GST Registration Allowed Subject to Filing of Returns and Payment of Dues -Jammu & Kashmir High Court

- റിട്ടേണുകൾ സമർപ്പിക്കുകയും കുടിശ്ശികകൾ അടയ്ക്കുകയും ചെയ്യുന്നുവെന്ന നിബന്ധനയ്ക്ക് വിധേയമായി ജിഎസ്ടി രജിസ്ട്രേഷൻ പുനഃസ്ഥാപിക്കാൻ ജമ്മു & കാശ്മീർ ഹൈക്കോടതി അനുമതി നൽകി.

- Allahabad High Court Quashes GST Demand Over Procedural Lapses: Wrong GSTIN, Demand Beyond SCN & Improper Service.

- തെറ്റായ GSTIN, അറിയിക്കാത്ത അധിക ഡിമാൻഡ്, നോട്ടീസ് ലഭിക്കാത്തത് – ഗുരുതര പിഴവുകൾ ചൂണ്ടിക്കാട്ടി GST ഉത്തരവ് അലഹാബാദ് ഹൈക്കോടതി റദ്ദാക്കി.

- No More Silent Auditor Changes — ICAI Releases Updated UDIN Portal Manual with Strong New Mandates.

Popular Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

BRQ GLOB TECH

BRQ GLOB TECH